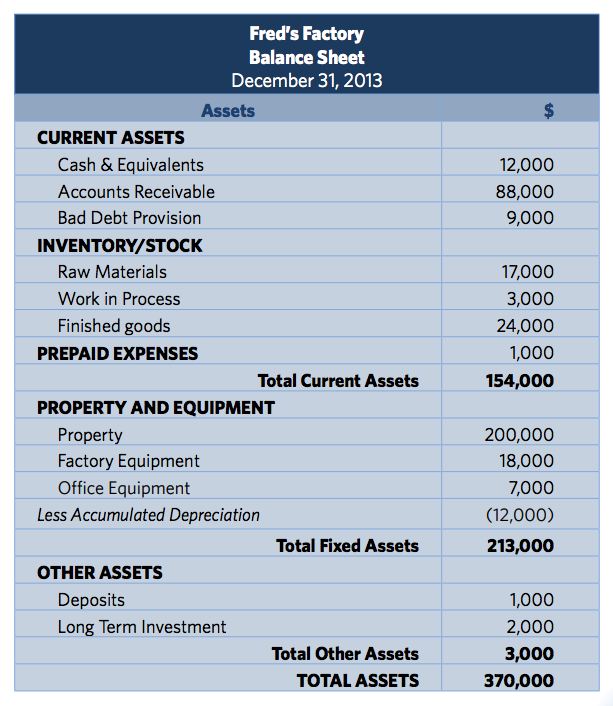

The table below shows how Fred’s Factory’s assets would be shown on the balance sheet.

Within this section you will find the total figures under the following headings. The first three headings comprise Fred’s total current assets:

● Current Assets

● Inventory/Stock

● Prepaid Expenses

● Property and Equipment (Fixed Assets)

● Other Assets

Current Assets

Under this heading is a list of all assets that can either be converted to cash or used to pay current liabilities within 12 months. Typical current assets include:

● Cash and cash equivalents

● Short-term investments

● Accounts receivable

● Bad debt provision

These are the assets that produce most of the liquidity in an organization and are the main source of working capital.

Cash and Cash Equivalents

Cash is the most liquid asset of all and is the first item included on the balance sheet. It refers to currency or currency equivalents that Fred’s Factory can access immediately or within a few days.

It also includes their petty cash fund and all of the money available in their current accounts plus any cash reserves. The latter may be kept in the form of savings accounts,

bank certificates, money market accounts, or other short-term investments.

Accounts Receivable

This consists of the short-term obligations owed to Fred’s Factory by its clients or through its trade accounts—for example when they sell their products or services on credit. These obligations are held in the current assets account until the customers pay them off.

Bad Debt Provision

This is simply an estimated amount that Fred’s Factory allocates for the possibility that some sales will not be paid for and will have to be written off. From past experience Fred’s will know what percentage of its sales fall into this category and use this figure to guide the amount allocated as bad debt provision. Any organization that sells on a credit basis will sooner or later experience bad debt and this reserve is used to absorb the cost of bad debts as they occur.

Inventory/Stock

This section covers production materials or products purchased or manufactured and then held by Fred’s Factory for sale. As a manufacturer they will divide this section into:

● Raw materials—these are the materials and components required by Fred’s to make its products.

● Work in process (WIP)—includes those raw materials and components that are being used in the production of Fred’s finished goods as well as those products as yet unfinished. The balance sheet will include raw materials costs as well as the labor and related costs applied to those materials during the manufacturing process.

● Finished goods—are all those products ready to be sold and the figure on the balance sheet includes all labor costs and related overheads such as factory rent supervision and product inspection.

In the case of retailers, distributors, and trading companies who purchase fully manufactured products that they simply resell, the balance sheet will usually show only a single line for this item.

Prepaid Expenses

These are expenses that have been paid in advance and therefore will not have to be paid again. For example,

When the accounting periods are monthly, an eleven-twelfths portion of an annually paid insurance cost is added to prepaid expenses, which are decreased by one twelfth of the cost in each subsequent period when the same fraction is recognized as an expense, rather than all in the month in which such cost is billed.

The not-yet-recognized portion of such costs remains as prepayments (assets) to prevent such cost from turning into a fictitious loss in the monthly period it is billed, and into a fictitious profit in any other monthly period.

Other examples of prepaid expenses Fred’s might have are property taxes or income tax installments. The reasoning behind this is that if an annual insurance policy were

canceled halfway through its year, half of the premium already paid would be refunded. This would represent an account receivable from the insurance company and therefore

represent an asset.

There are instances where some invoices contain a small prepayment aspect that is so small that separating the prepaid and current aspects are not worthwhile or are too complex. For example, some phone or utility bills have a standing charge that covers a future period. Such items will usually appear in the accounts payable figure on the balance sheet.

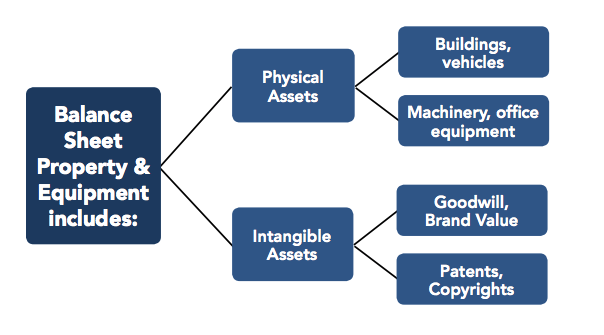

Property and Equipment

These are also known as a non-current assets, fixed assets, or as property, plant, and equipment (PP&E). Every organization requires physical assets that it uses to conduct its

business. For Fred’s this includes such items as its buildings, manufacturing equipment, vehicles, and office equipment.

‘Property and Equipment’ also includes intangible assets, such as goodwill, patents, or copyright, which is why many organizations refer to this section as non-current assets.

These assets may not be physical in nature, but they are ‘life-blood’ (e.g. a brand name) and without them the organization would fail. The value of your organization’s non-current assets should not be underestimated.

Your organization will calculate and deduct depreciation from most of these assets, which represents the economic cost of the asset over its useful life. These assets are

used for extended periods of time (usually years) and are thus not current assets as they are not held for resale to customers. As such, they cannot be considered sources of

liquidity or cash flow.

Accumulated Depreciation

The value of a fixed asset will usually decline over time and for accounting purposes an organization needs to depreciate its assets in a controlled and uniform manner. This figure is then subtracted from the total value of all its non-current assets.

Many items have a standard way in which depreciation is applied to them and you need to understand the rules that your organization adheres to. For example,

An item of manufacturing equipment cost $50,000 and has an expected life span of 10 years. To recognize and allocate this cost over its life span an organization will write-down its cost at rate of $5,000 per year.

The total amount written off in this way since the fixed asset was purchased is shown under accumulated depreciation on the balance sheet. The total of this accumulated

depreciation for all an organization’s fixed assets is shown immediately after the original cost so that the net value of fixed assets can be shown.

It is important to appreciate that both ‘Property and Equipment’ and ‘Depreciation’ are always stated in cost figures regardless of their current market value. There are several reasons for this even if in some cases the market value is less than the purchase cost when the accumulated depreciation is subtracted:

● It would take too much time and money to obtain an appraisal for every asset the business owns.

● The frequency required makes the task completely impractical, as well as virtually impossible to verify.

● The cost minus accumulated depreciation figure has the virtue of being difficult to manipulate as well as providing a uniform standard.

● Meaningful comparisons can be made between companies.

Other Assets

These are items in Fred’s Factory that are neither current nor fixed. They could include:

● An investment held for an extended period of time.

● A deposit paid to the landlord from whom the company leases its offices.

The reason why a deposit paid to a landlord is not classified as an expense is that it could be applied against the final rent invoice or returned to the tenant when the property is vacated. It must therefore be classified as an asset.

Key Points

* Current assets include cash and cash equivalents, short-term investments, accounts receivable, and bad debt provision.

* Inventory includes raw materials, work in process, and finished goods.

* Prepaid expenses are those things that have been paid in advance like insurance premiums, property taxes, and income tax installments.

* Property and equipment includes such items as buildings, manufacturing equipment, vehicles, and office equipment.

* Accumulated depreciation allows an organization to depreciate its assets in a controlled and uniform way.