The Internet boom of the late 1990s was a classic example of hundreds of companies coming to the market with no history of earning – some of them didn’t even have products yet. Their stock prices soared only to come crashing down later. Fortunately, that’s behind us.

However, we still have the problem of needing some measure of young companies with no earnings, yet worthy of consideration. After all, Microsoft had no earnings at one point in its corporate life.

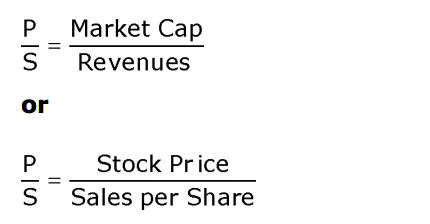

One ratio you can use is Price to Sales or P/S ratio. This metric looks at the current stock price relative to the total sales per share. You calculate the P/S by dividing the market cap of the stock by the total revenues of the company.

You can also calculate the P/S by dividing the current stock price by the sales per share.

Much like P/E, the P/S number reflects the value placed on sales by the market. The lower the P/S, the better the value, at least that’s the conventional wisdom. However, this is definitely not a number you want to use in isolation. When dealing with a young company, there are many questions to answer and the P/S supplies just one answer.

Price to sales ratio is relatively volatile in comparison to other ratios. This ratio is suitable for growth companies. A requirement for a growth company is strong consistent sales growth.