Elliott Wave theory suggests that stock prices move in clear trends. These trends can be classified in two parts i.e.

A. Dominant trend (Five wave pattern)

B. Corrective trend (Three wave pattern)

A. Dominant Trend (Five wave pattern)

Basically Dominant Trend consists of five waves. These five waves can be in either direction, up or down.

When fi ve waves directions is up then advancing waves are known as impulsive waves and declining waves are known as corrective waves.

Similarly when fi ve waves directions is down then declining waves are known as impulsive waves and advancing waves are known as corrective waves.

This would be more clearer from (Figure 6) & (Figure7)

(Figure 6) illustrates a rising 5-wave sequence. Here markets are rising. Wave 1, 3 & 5 are impulse waves. Wave 2 & 4 is corrective waves.

(Figure 7) illustrates a declining 5-wave sequence. Here markets are declining. Wave 1, 3 & 5 are impulsive waves. Wave 2 & 4 is corrective waves.

Characteristic of Dominant Trend (when markets are rising)

Each individual Wave of the dominant trend has its own characteristic. One should understand these characteristics which is the key to practical application of Elliott Theory. These are described as-

* Wave 1: Wave 1 is usually a weak rally with only small number of traders participating in the market. This is because fundamental news is still negative and above all previous trend which was declining is still considered strong to be in force.

* Wave 2: Wave 2 is a sell off once wave 1 is over and these sell off is very vicious (sharp). But wave 2 never extends beyond the starting point of wave 1. Wave 2 finally ends without making new lows and prices turn for another rally.

*Wave 3: The initial stage of the wave 3 is a slow rally as market participants are not convinced about the rally. Practically lot of sell side positions are there in the market and these get squared off as and when markets rally and finally sell side positions are closed when top of wave 1 is crossed. This is the time when top of wave 1 is crossed market participants are convinced about the rally and there is sudden buy side interest in the market. Wave 3 is usually the largest and most powerful wave of dominant trend.

* Wave 4: Finally wave 3 ends as traders who were long from the lower levels takes profits, hence profit taking starts. Basically wave 4 is a clear correction on lesser volume than wave 3.While profit taking is on, majority of the market participants are convinced that trend is up. There are two schools of thoughts here to trade Wave 4. One is to buy on decline if one understands the potential ahead for wave 5. The other is to wait for wave 4 to end and buy when market rallies again.

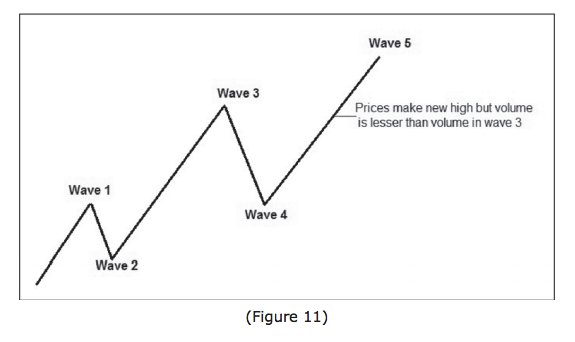

* Wave 5: Wave 5 is the last wave of dominant trend. Although prices make new high above wave 3 but volumes is usually lesser than volume in wave 3.The wave 5 lacks the strength witnessed in wave 3 rallies and finally markets tops out and enter new phase.

Characteristic of Dominant Trend (when markets are declining)

* Wave 1: Wave 1 is usually a small correction with only small number of traders participating in the market. This is because fundamental news is still positive and above all previous trend which was rising is still considered to be strong in force.

* Wave 2: Wave 2 is a strong rally once wave 1 is over. But wave 2 never extends beyond the starting point of wave 1. Wave 2 fi nally ends without making new highs and prices starts declining again.

Wave 3: The initial stage of the wave 3 is a slow decline as market participants are not convinced about the decline. Practically lot of buy side positions are there in the market and these get squared off as and when markets declines and finally buy side positions are closed when bottom of wave 1 is crossed. This is the time when bottom of wave 1 is crossed, market participants are convinced about the decline and there is sudden sell side interest in the market. Wave 3 is usually the largest and most powerful wave of dominant trend.

Wave 4: Finally wave 3 ends as traders who were short from the higher levels takes profit, hence profit taking starts. Basically wave 4 is a clear pull back on lesser volume than wave 3.While profit taking is on, majority of the market participants are convinced that trend is down. There are two schools of thoughts here to trade Wave 4. One is to sell on rally if one understands the potential ahead for wave 5.The other is to wait for wave 4 to end and sell when market declines again.

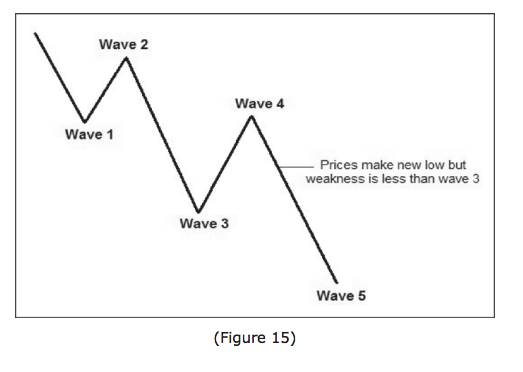

Wave 5: Wave 5 is the last wave of dominant trend. Although prices make new low below the wave 3 but volumes is usually lesser than volume in wave 3.The wave 5 lacks weakness found in wave 3 declines and finally markets bottoms out and enter new phase.

B. Corrective trend (Three wave pattern)

Corrective Trend consists of three waves. Basically three wave corrective trend starts when fi ve wave dominant trend ends.

After market rallies in a basic 5 wave sequence, market top is made and markets enter a new phase i.e. three wave downward corrective phase i.e. A, B and C which would be clearer from (Figure 16).

(Figure16) illustrates ABC corrective sequence after market rallied in a basic five wave sequence. Here entire move is clearly down after Wave 5 is formed. Hence Wave A and C are impulse waves and wave B is a corrective wave.

Similarly After market declines in a basic 5 wave sequence, market bottom is made and markets enter a new phase i.e. three wave upward corrective phase i.e. A, B and C which would be clearer from (Figure 17).

(Figure17) illustrates ABC corrective sequence after market declined in a basic five wave sequence. Here entire move is clearly up after Wave 5 is formed. Hence Wave A and C are impulse waves and wave B is a corrective wave.

Characteristic of Corrective Waves after market rallies in a basic fi ve wave sequence

Each individual Wave of the corrective trend has its own characteristic. One should understand

these characteristics which is the key to practical application of Elliott Theory. These are

described as-

Wave A: Wave A is the beginning of a new bear market, fundamental news is still positive and nobody is ready to accept the fact that markets can decline.

Wave B: Wave B is basically a small rally which gives the feeling that Bull Run has again started but prices fail to make new high and typical volume characteristic here is that Volume in Wave B is lesser than Wave A.

Wave C: Here prices again starts declining and volume also pick up and it’s in Wave C that everyone realizes that market decline is likely to continue and hence market participation on the sell side increases.

Characteristic of Corrective Waves after market declines in a basic fi ve wave sequence

Wave A: Wave A is the beginning of a new bull market, fundamental news is still negative and nobody is ready to accept the fact that markets could rally.

Wave B: Wave B is basically a small decline which gives the feeling that decline has again started but prices fail to make new low and typical volume characteristic here is that Volume in Wave B is lesser than Wave A.

Wave C: Here prices again starts rising and volume also pick up and it’s in Wave C that everyone realizes that market rally is likely to continue and hence market participation on the buy side increases.

Combining fi ve wave dominant sequences with a three wave corrective sequence completes basic fundamental concept behind Elliott Theory.

C. Pattern Recognition and Fractals

Elliott Wave theory suggests that stock prices move in clear trends which can be defined as five wave dominant trends followed by three wave corrective trend. Basically one looks at price chart to define these trends i.e. dominant trend or corrective trend. Hence it can be said that these waves move in certain patterns and application of Elliott Wave theory is a form of pattern recognition.

Elliott Wave theory suggests that irrespective of size of the wave, all impulse waves are subdivided into five smaller waves and all corrective waves are subdivided into three smaller waves. Hence Elliot Wave is a fractal (Fractal is typically a self similar patterns appearing at every degree of trend where self similar means they are “the same from near as from far”). This would be more clearer for (Figure 18) and (Figure 19) which shows fractal nature of Elliott Wave.

D. Elliot Wave Rules and Guidelines

Elliot Wave Rules-There is basically three indispensable rules i.e. it’s necessary that these rules should hold true all of the time.

Rule 1: Wave 2 cannot retrace more than 100% of Wave 1 i.e. in the rising market Wave 2 would not break bottom of Wave 1 and similarly in declining market Wave 2 would not break top of Wave 1. This would be clearer from (Figure 20)

If Wave 2 retraces more than 100% of Wave 1 then it means something is wrong with the wave count and there is a crucial need for a wave re-count.

Rule 2: Wave 3 is never the shortest- This means that Wave 3 is always longer than other two waves i.e. Wave 1 or Wave 2. Practically Wave 3 is longer than other two waves. If you find wave 3 shorter than other two waves then it means something is wrong with the wave count and there is a crucial need for a wave re-count. Wave 3may end up being equal in length but never shortest.

Rule 3: Wave 4 can never overlap Wave 1 – This means that end of wave 4 should not trade below the peak of wave 1. This would be more clearer from (Figure 21) and (Figure 22). This rule is for cash market i.e. capital market segment on NSE and for derivative market segment on NSE 5-7% overlap is allowed for both equity futures and currency futures. This is so because cost of carry is there and higher side overlaps are basically seen in declining market.

(Figure 21) illustrates that Wave 4 end above the peak of Wave 1.

(Figure 22) illustrates that Wave 4 end above the peak of Wave 1.

Elliot Wave guidelines- There are basically three guidelines. The difference between rules and guidelines is that it’s necessary that rules should hold true all of the time but it’s not necessary that guidelines should hold true all of the time, basically guideline hold true most of the time.

Guideline 1: When Wave 3 is longest wave then mostly wave 5 is equal in length to Wave 1.This provides target for end of Wave 5.Even though Wave 5 can be longer than Wave 3 and Wave 3 could still be longer than Wave 1 but this helps in providing at least conservative target for end of Wave 5.

Guideline 2: The form of Wave 2 and Wave 4 corrections are alternate i.e. if Wave 2 is vicious (sharp) sell off then Wave 4 would be fl at correction and if Wave 2 is fl at correction then Wave 4 would be vicious (sharp) sell off.

Guideline 3: Three Wave corrective pattern (A, B, C) after fi ve wave dominant pattern (1, 2, 3, 4, 5) ends prior to end of Wave 4 of dominant trend. This would be more clearer from (Figure 23) and (Figure 24)

(Figure 23)

(Figure 24)

E. Fibonacci Sequence

Fibonacci sequence is named after Leonardo Pisano Bogollo (1170-1250), and he lived in Italy

The Fibonacci sequence is the series of numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34 …………..

The next number is found by adding up the two numbers before it. For example

i. The 2 is found by adding the two numbers before it (1+1)

ii. The 3 is found by adding the two numbers before it (1+2),

iii. The 5 is found by adding the two numbers before it (2+3)

iv. and the next number in the sequence above would be 21+34 = 55

Hence Fibonacci sequence can be defined by a mathematical formula i.e.

XN= XN-1 +XN-2 Where XN and N stands for

Here

XN is term number “N”

XN-1 is the previous term (N-1)

XN-2 is the term before that (N-2)

The Fibonacci sequence is used in many fields including stock market. Basically for stock market trading, one needs to know only this regarding Fibonacci sequence.

The most common Fibonacci sequence used in the stock markets is:

F. Golden Ratio

In Mathematics and in arts, ratio is considered Golden, if ratio of the sum of two quantities to the larger quantity is equal to the ratio of the larger quantity to the smaller quantity. Let’s understand this with an example. There are two quantities say A and B, where A is larger than B.

If (A+B)/A= A/B then answer is Golden Ratio which is 1.6180339887… This Golden ratio is observed, if you take ratio of any two successive Fibonacci numbers. It

comes very close to 1.618034……. .Practically bigger the pair of Fibonacci numbers closer the approximation to the Golden ratio.

This Golden ratio appears frequently in stock market, basically near to levels where wave tops and bottoms are being made. Therefore Golden ratio helps in identifying key turning points of the waves and thus helps in predicting the price trend. This would be clearer from Fibonacci relationships.

G. Fibonacci Retracement– It’s based on the numbers identified in Fibonacci sequence to define area of support and resistance. It is created by taking two extreme points (usually a major peak and trough) on a price chart and then dividing the vertical distance by key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%. Once these levels are identified, horizontal lines are drawn to indicate areas of support or resistance at the key Fibonacci levels before prices continue to move in the original direction. This is illustrated in (Figure 25). Practical application of Fibonacci retracements would be clearer from Fibonacci relationship.

H. Fibonacci Relationship

It has been observed that the Fibonacci summation series is the basis of Elliot Wave theory as Fibonacci numbers come up repeatedly in Elliot Wave Structure. But interesting thing is that after Elliott theory was developed, it was observed that it reflected Fibonacci sequence. The first wave in Elliott Theory is Wave 1.The length of Wave 1 is used for predicting the length of other waves with the help of Fibonacci retracements and ratios. Hence each wave is related to some other wave in terms of Fibonacci ratio or retracement and these relationships are known as Fibonacci relationship. These relationships are not rules but guidelines in estimating length of the other waves and it’s defined as

I. Fibonacci relationship for wave 2:

Wave 2 is always related to Wave 1.

Wave 2 = either 50 % retracement of Wave 1 or

Wave 2 = 61.8 % retracement of Wave 1.

Fibonacci relationship for Wave 3:

Wave 3 is always related to Wave 1.

Wave 3 = either 1.618 times the length of Wave 1 or

Wave 3 = 2.618 times the length of Wave 1 or

Wave 3 = 4.23 times the length of Wave 1

II. Fibonacci Relationship for Wave 4:

Wave 4 is always related to Wave 3.

Wave 4= either 23.6% retracement of Wave 3 or

Wave 4= 38.2% retracement of Wave 3 or

Wave 4= either 50 % retracement of Wave 3

In any case Wave 4 is not more than 61.8% retracement of Wave3.

III. Fibonacci Relationship for Wave 5:

i. Wave 5 is related to Wave 1. If Wave 3 is more than 1.618 times the length of Wave 1 then

Wave 5 = either Wave 1 or

Wave 5 = 1.618 times the length of Wave 1 or

Wave 5 = 2.618 times the length of Wave 1.

ii. Wave 5 is related to entire length from bottom of Wave 1 to the top of Wave 3. If Wave 3 is less than 1.618 times the length of Wave 1 then

Wave 5 = either 1.618 times the entire length from bottom of Wave 1 to the top of Wave 3 or

Wave 5 = 2.618 times the entire length from bottom of Wave 1 to the top of Wave 3.

IV. Fibonacci Relationship for Wave A:

Wave A is related to Wave 5.

Wave A= either 23.6% retracement of Wave 5 or

Wave A= 38.2% retracement of Wave 5.

V. Fibonacci Relationship for Wave B:

Wave B is related to Wave A.

Wave B = either 50 % retracement of Wave A or

Wave B = 61.8 % retracement of Wave A.

VI. Fibonacci Relationship for Wave C:

Wave C is related to Wave A.

Wave C = either 1.618 times the length of Wave A or

Wave 3 = 2.618 times the length of Wave A.