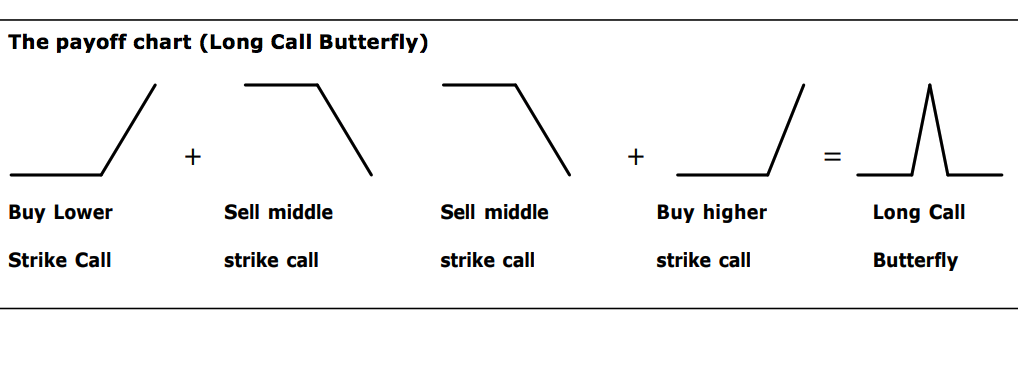

A Long Call Butterfly is to be adopted when the investor is expecting very little movement in the stock price / index. The investor is looking to gain from low volatility at a low cost. The strategy offers a good risk / reward ratio, together with low cost. A long butterfly is similar to a Short Straddle except your losses are limited. The strategy can be done by selling 2 ATM Calls, buying 1 ITM Call, and buying 1 OTM Call options (there should be equidistance between the strike prices). The result is positive incase the stock / index remains range bound. The maximum reward in this strategy is however restricted and takes place when the stock / index is at the middle strike at expiration. The maximum losses are also limited. Let us see an example to understand the strategy.

When to use: When the investor is neutral on market direction and bearish on volatility.

Risk Net debit paid.

Reward Difference between adjacent strikes minus net debit

Break Even Point:

Upper Breakeven Point = Strike Price of Higher Strike Long Call – Net Premium Paid

Lower Breakeven Point = Strike Price of Lower Strike Long Call + Net Premium Paid

Example: Nifty is at 3200. Mr. XYZ expects very little movement in Nifty. He sells 2 ATM Nifty Call Options with a strike price of Rs. 3200 at a premium of Rs. 97.90 each, buys 1 ITM Nifty Call Option with a strike price of Rs. 3100 at a premium of Rs. 141.55 and buys 1 OTM Nifty Call Option with a strike price of Rs. 3300 at a premium of Rs. 64. The Net debit is Rs. 9.75.