A Short Call Butterfly is a strategy for volatile markets. It is the opposite of Long Call Butterfly, which is a range bound strategy. The Short Call Butterfly can be constructed by Selling one lower striking in-the-money Call, buying two at-the-money Calls and selling another higher strike out-of-the-money Call, giving the investor a net credit (therefore it is an income strategy). There should be equal distance between each strike. The resulting position will be profitable in case there is a big move in the stock / index. The maximum risk occurs if the stock / index is at the middle strike at expiration. The maximum profit occurs if the stock finishes on either side of the upper and lower strike prices at expiration. However, this strategy offers very small returns when compared to straddles, strangles with only slightly less risk. Let us understand this with an example.

When to use: You are neutral on market direction and bullish on volatility. Neutral means that you expect the market to move in either direction – i.e. bullish and bearish.

Risk Limited to the net difference between the adjacent strikes (Rs. 100 in this example) less the premium received for the position.

Reward Limited to the net premium received for the option spread.

Break Even Point:

Upper Breakeven Point = Strike Price of Highest Strike Short Call – Net Premium Received

Lower Breakeven Point = Strike Price of Lowest Strike Short Call + Net Premium Received

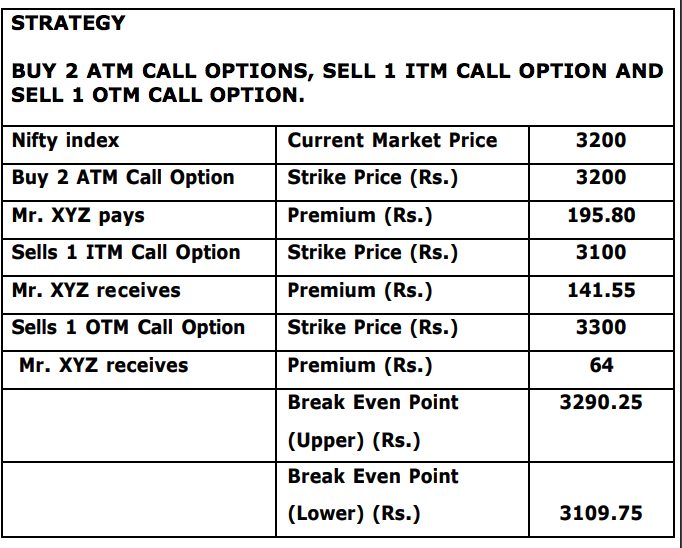

Example: Nifty is at 3200. Mr. XYZ expects large volatility in the Nifty irrespective of which direction the movement is, upwards or downwards. Mr. XYZ buys 2 ATM Nifty Call Options with a strike price of Rs. 3200 at a premium of Rs. 97.90 each, sells 1 ITM Nifty Call Option with a strike price of Rs. 3100 at a premium of Rs. 141.55 and sells 1 OTM Nifty Call Option with a strike price of Rs. 3300 at a premium of Rs. 64. The Net Credit is Rs. 9.75.