A Long Combo is a Bullish strategy. If an investor is expecting the price of a stock to move up he can do a Long Combo strategy. It involves selling an OTM (lower strike) Put and buying an OTM (higher strike) Call. This strategy simulates the action of buying a stock (or a futures) but at a fraction of the stock price. It is an inexpensive trade, similar in pay-off to Long Stock, except there is a gap between the strikes (please see the payoff diagram). As the stock price rises the strategy starts making profits. Let us try and understand Long Combo with an example.

When to Use: Investor is Bullish on the stock.

Risk: Unlimited (Lower Strike + net debit)

Reward: Unlimited

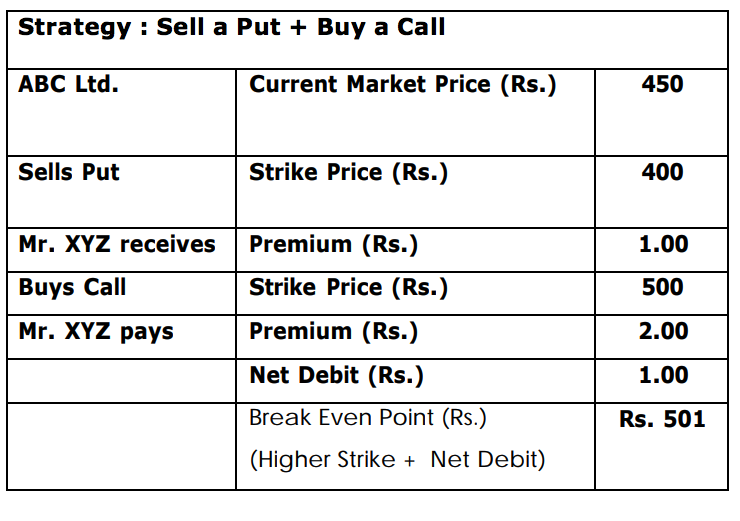

Breakeven : Higher strike + net debit

Example: A stock ABC Ltd. is trading at Rs. 450. Mr. XYZ is bullish on the stock. But does not want to invest Rs. 450. He does a Long Combo. He sells a Put option with a strike price Rs. 400 at a premium of Rs. 1.00 and buys a Call Option with a strike price of Rs. 500 at a premium of Rs. 2. The net cost of the strategy (net debit) is Rs. 1.

For a small investment of Re. 1 (net debit), the returns can be very high in a Long Combo, but only if the stock moves up. Otherwise the potential losses can also be high.