You own shares in a company which you feel may rise but not much in the near term (or at best stay sideways). You would still like to earn an income from the shares. The covered call is a strategy in which an investor Sells a Call option on a stock he owns (netting him a premium). The Call Option which is sold in usually an OTM Call. The Call would not get exercised unless the stock price increases above the strike price. Till then the investor in the stock (Call seller) can retain the Premium with him. This becomes his income from the stock. This strategy is usually adopted by a stock owner who is Neutral to moderately Bullish about the stock.

An investor buys a stock or owns a stock which he feel is good for medium to long term but is neutral or bearish for the near term. At the same time, the investor does not mind exiting the stock at a certain price (target price). The investor can sell a Call Option at the strike price at which he would be fine exiting the stock (OTM strike). By selling the Call Option the investor earns a Premium. Now the position of the investor is that of a Call Seller who owns the underlying stock. If the stock price stays at or below the strike price, the Call Buyer (refer to Strategy 1) will not exercise the Call. The Premium is retained by the investor.

In case the stock price goes above the strike price, the Call buyer who has the right to buy the stock at the strike price will exercise the Call option. The Call seller (the investor) who has to sell the stock to the Call buyer, will sell the stock at the strike price. This was the price which the Call seller (the investor) was anyway interested in exiting the stock and now exits at that price. So besides the strike price which was the target price for selling the stock, the Call seller (investor) also earns the Premium which becomes an additional gain for him. This strategy is called as a Covered Call strategy because the Call sold is backed by a stock owned by the Call Seller (investor). The income increases as the stock rises, but gets capped after the stock reaches the strike price. Let us see an example to understand the Covered Call strategy.

When to Use: This is often employed when an investor has a short-term neutral to moderately bullish view on the stock he holds. He takes a short position on the Call option to generate income from the option premium.

Since the stock is purchased simultaneously with writing (selling) the Call, the strategy is commonly referred to as “buy-write”.

Risk: If the Stock Price falls to zero, the investor loses the entire value of the Stock but retains the premium, since the Call will not be exercised against him. So maximum risk = Stock Price Paid – Call Premium Upside capped at the Strike price plus the Premium received. So if the Stock rises beyond the Strike price the investor (Call seller) gives up all the gains on the stock.

Reward: Limited to (Call Strike Price – Stock Price paid) + Premium received

Breakeven: Stock Price paid – Premium Received

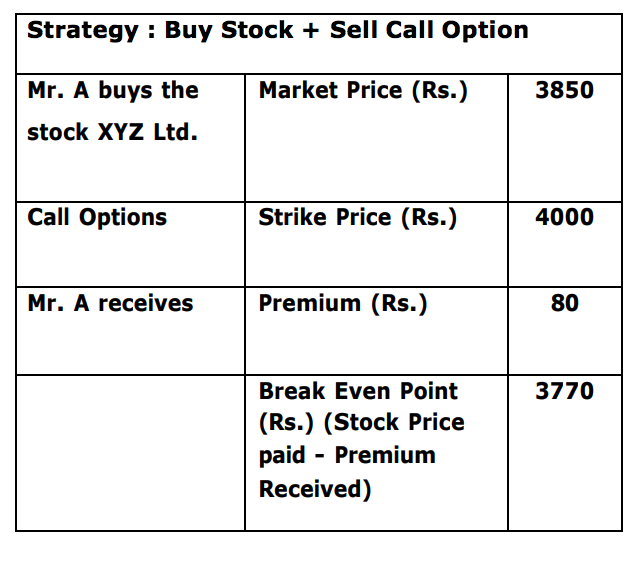

Example

Mr. A bought XYZ ltd. for RS 3850 and simultaneously sells a Call option at an strike price of Rs 4000. Which means Mr. A does not think that the price of XYZ ltd. will rise above Rs. 4000. However, incase it rises above Rs. 4000 Mr. A dose not mind getting exercised at that price and exiting the stock at Rs. 4000 (TARGET SELL PRICE = 3.90% return on the stock purchase price). Mr. A receives a premium of Rs 80 for selling the Call. Thus net outflow to Mr. A is (Rs. 3850 – Rs. 80) = Rs. 3770. He reduces the cost of buying the stock by this strategy.

If the stock price stays at or below Rs. 4000, the Call option will not get exercised and Mr. A can retain the Rs. 80 premium, which is an extra income.

If the stock price goes above Rs 4000, the Call option will get exercised by the Call buyer. The entire position will work like this :

Example :

1) The price of XYZ Ltd. stays at or below Rs. 4000. The Call buyer will not exercise the Call Option. Mr. A will keep the premium of Rs. 80. This is an income for him. So if the stock has moved from Rs. 3850 (purchase price) to Rs. 3950, Mr. A makes Rs. 180/- [Rs. 3950 – Rs. 3850 + Rs. 80 (Premium) ] = An additional Rs. 80, because of the Call sold.

2) Suppose the price of XYZ Ltd. moves to Rs. 4100, then the Call Buyer will exercise the Call Option and Mr. A will have to pay him Rs. 100 (loss on exercise of the Call Option). What would Mr. A do and what will be his pay – off?